The Impact of Returning to “Normal.” A Covid Story.

If you’ve said, “2020 was my best year” or “we grew in 2020 despite the pandemic” you might be in for a reset in 2021 and into 2022. We don’t want to alarm you, but we do want to help you set realistic expectations. It may be best to expect a pullback from 2020 numbers.

2020 Success May Not Be So Easy to Maintain

When Covid hit in early 2020, we saw clients with digital products, digital solutions, online businesses, and even some brick and mortar companies thrive. Additionally, companies that invested aggressively to grow during the downturn were able to outmaneuver competitors who didn’t have the foresight, or the funds, to remain strong when business slowed.

Similarly, certain industries boomed as people were forced to work from home, vacations were canceled, and out-of-home activities were locked down. Home improvement stores, home gym equipment brands, VRBO, digital health clinics, online retailers, delivery services, game companies, and select others thrived. Meanwhile, airlines, hospitality, brick and mortar retail, restaurants, event and conference facilities, and many other industries struggled.

Adding to the disruption, companies that usually see a lull during the summer vacation months saw more activity than usual. There was a lot of unused vacation time in 2020—precisely when most people needed a break more than ever. Lynda Lambert with AAA said that 33% of Americans’ vacation time went unused in 2020. This was up from 27.7% in 2018 and 25.9% in 2017, respectively, as reported by CNN Travel.

Many businesses that typically don’t see much growth in the summer months benefitted in 2020 because fewer individuals were away vacationing.

Many businesses that typically don’t see much growth in the summer months benefitted in 2020 because fewer individuals were away vacationing. In the summer of 2021, the term “rage vacationing” began trending. It described the frustration felt due to the inventory shortage of rental cars across the US, and the skyrocketing prices that went with it.

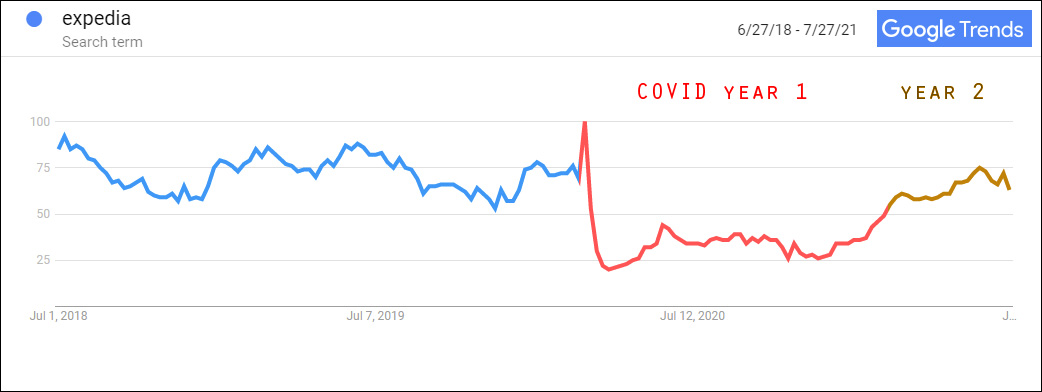

Online travel giant Expedia took a significant hit along with most travel sites early in the pandemic. The scramble to create infrastructure around travel cancellations and flexible bookings was the only positive mover during the first few months of the pandemic. As domestic and limited international travel continues to return, we’re seeing those volumes rise, which will mean fewer potential customers during the travel season. So, businesses that saw gains during the summer of 2020 should be cautious about expecting to beat those levels.

Competition is Heating Up

In April and May of 2021, many sectors were seeing business slow down compared with 2020 numbers. It may not be fair to use 2020 for comparison, but there is still value in studying the numbers, even from such an unusual year. In fact, you should be looking back over the last two years to help you set expectations with clients, and within your own business.

Why? Because competition is increasing. And not just from your direct competitors, but also competition for your customers’ time. More restaurants are open, stadiums are opening up in varying capacities, travel restrictions are being lifted in many regions, in-person conferences are being planned, gyms are opening doors again, movie theaters are setting opening dates, and even Broadway is planning its return. There are places to go and things to do again! As this continues, revenue will likely dwindle in 2021 for businesses that were positioned to do well in 2020. This means you may need to look to 2019 and even 2018 to understand what to expect, and project, in 2021 and 2022.

Now, during the summer, people are traveling again. According to research conducted by Expedia, 44 percent of U.S. consumers are planning to take more trips this year as compared to last. And it shows.

Last year (2020), airports looked like this:

Today (August of 2021), they look like this:

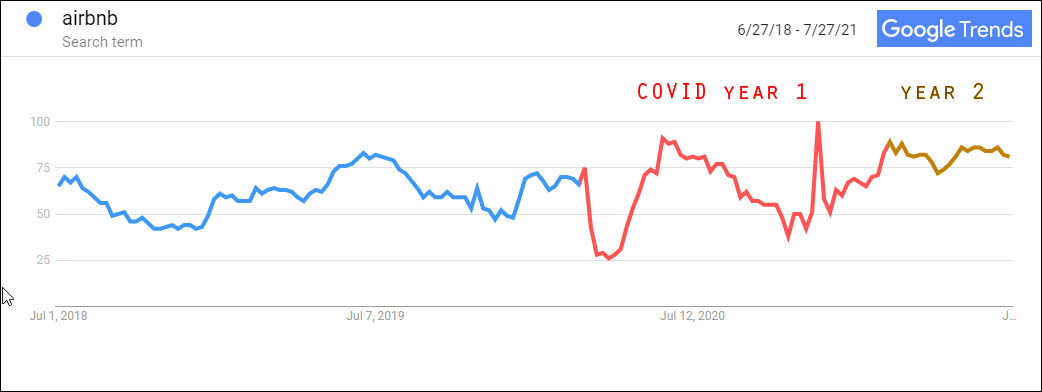

According to the Transportation Security Administration, more than 2.2 million passengers passed through security checkpoints on July 18, 2021, the highest number in a year. Not only that, but vacation rental properties are also in high demand as families view them as safe ways to enjoy some leisure time. The customers you had last year are busy traveling this year.

Airbnb has seen continued success as domestic vacations are booming due to “rage travel.” Heck, I spent time on Route 66 this year for the first time in my life. It was glorious.

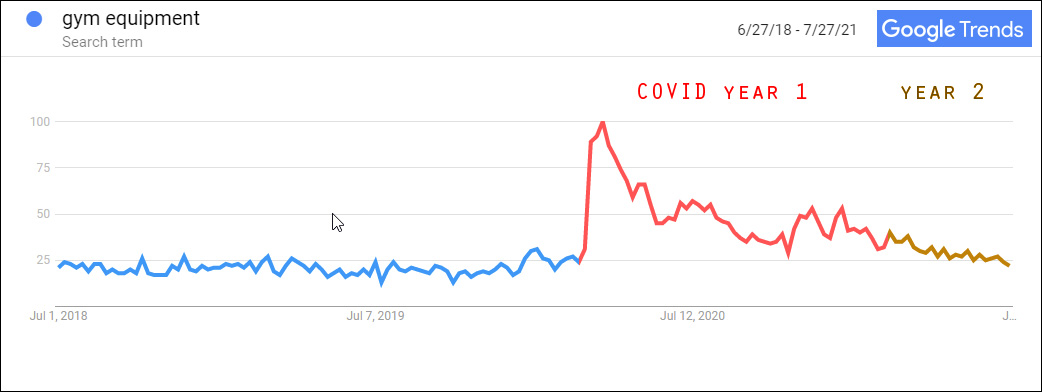

However, companies that saw a boom at the onset of the pandemic are quickly seeing things retract in 2021 and will continue to see this into 2022. For example, the home gym craze is quickly losing steam after a meteoric rise during the first year of the pandemic. Prices per pound of dumbbells were well above $2.00/lb from the onset of the pandemic. Now you’re seeing those prices creep closer to the $1.00/lb level as we start to see a return and demand wane.

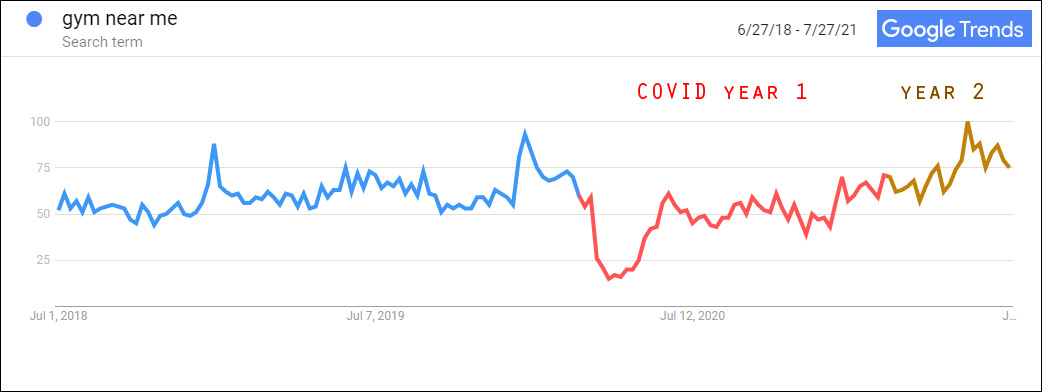

Conversely, gym membership search volume is returning, along with prices.

Organic Local Search Trends for “gym near me” dipped early but has more than recouped as masks are coming off and buildings are reopening. Sales of aftermarket equipment could drive home gym sales and prices even lower.

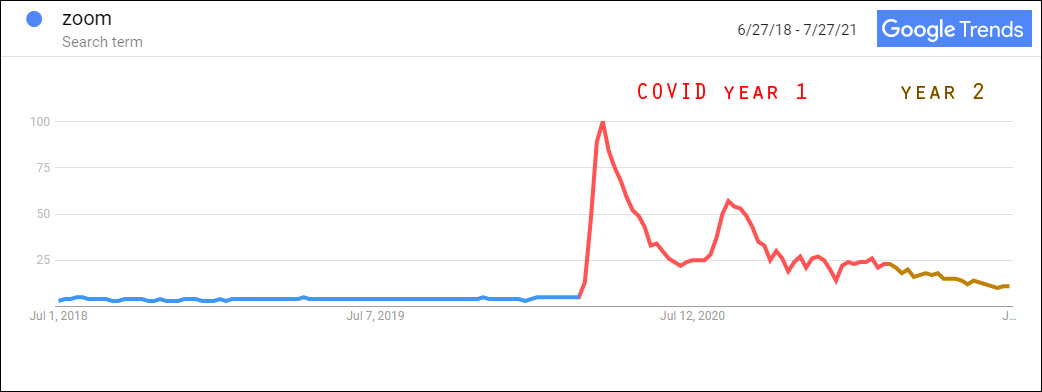

Zoom and other online conference companies also are seeing their time in the limelight dwindling. They won’t disappear in our new normal, but they should be considering options to retain and delight customers.

As seen in the chart above, Zoom zoomed early in Covid and will likely remain strong, but competition has cut sharply into its early success.

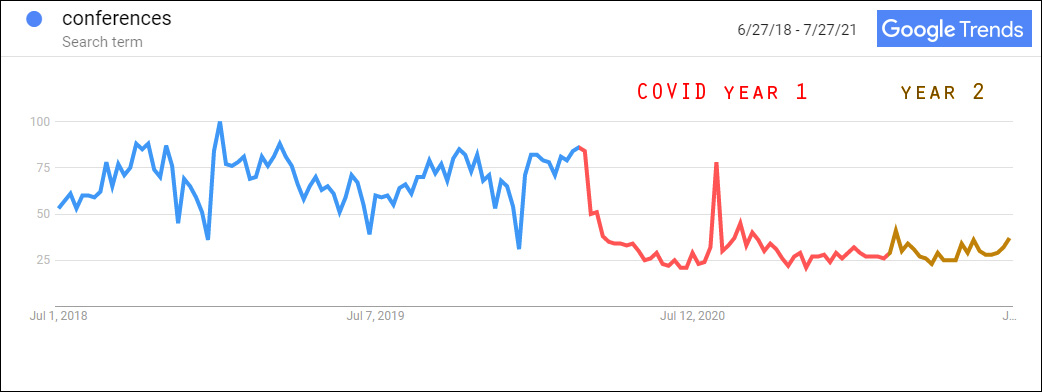

On the other hand, Organic Search Trends for “conferences” shows people are starting to look for conferences to attend in person rather than online.

What Should You Expect Post-Pandemic?

First off, we’re not out of the woods yet, so companies need to be mindful of their projections and expectations. Expect cost-per-click fees to increase as competitors continue to return to the office, production lines begin to catch up, and habits shift. Expect traffic to reduce as your customers have more options. Expect fewer customers during the summer seasons as people find new distractions. Look at years prior to 2020 to identify trends and set your projections and goals because if you’re solely looking at 2020’s numbers you may be setting yourself up for failure.

Finally, expect some of the online-specific successes to dip as customers opt for in-person or offline options that get them out of the house and pressing the flesh. The shift won’t be an instant transition; rather, it’ll ebb and flow and introduce new variables like the booming market for car rentals, used vehicles, and vacation rentals. And even those may suffer as borders begin to open. Stay tuned.